DISABILITY LIVING ALLOWANCE Stock Illustration Illustration of claim

Gains made from the disposal or transfer of assets. These Spanish tax rates on savings income are as follows from 2023. Spanish tax rate on savings income up to €6,000: 19%. Spanish tax rate on savings income from €6,000 to €50,000: 21%. Spanish tax rate on savings income from €50,001 to €200,000: 23%.

Disability Living Allowance (DLA) is Changing Modern Mobility

UK benefits for a disability or carer support. If you (or a parent or spouse) moved to live in Spain before 31st December 2020 you could still be entitled to one of the following UK allowances (among others) if you have a particular illness or disability, even if you are resident in Spain: Attendance Allowance or Carers' Allowance.

How to get disability allowance spunout

Disability Living Allowance (DLA) is a tax-free benefit for disabled people who need help with mobility or care costs. DLA is ending for people who were born after 8 April 1948 and are 16 or over.

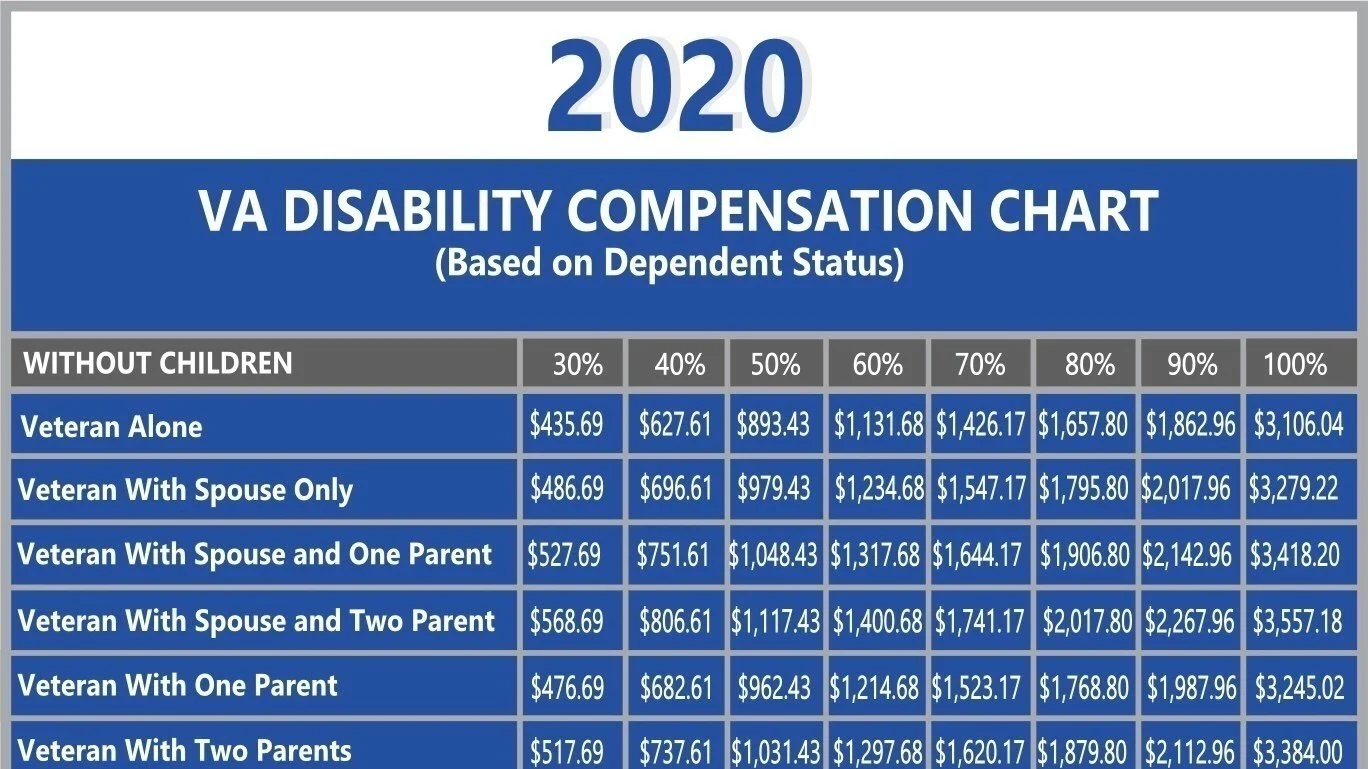

100 Disabled Veteran Housing Allowance Hill & Ponton, P.A.

You can also claim tax deductions for dependants. If you have children under 25 living with you, you can claim the following additional allowances: €2,400 for the first child. €2,700 for the second. €4,000 for the third. €4,500 for the fourth. An extra allowance of €2,800 for each child under three years. If you have an elderly.

Disabilityrelated allowances and tax credits in the United Kingdom and

A person who earns more than a certain monthly amount is considered to be "engaging in SGA," and thus not eligible for SSDI benefits. In 2024, the SGA amount is $1,550 for disabled applicants and $2,590 for blind applicants. (The SGA amount increases a bit each year due to federal regulations that use the national average wage index to set the.

Disability Economic Benefits, Spain, 1999 Download Table

In contrast to SSI, the monthly benefit for a Social Security disability recipient depends on prior earnings: how much and how long you worked and paid into the Social Security system (by paying FICA or self-employment taxes). The average monthly payment in 2024 is $1,537, and the most you can receive is $3,822.

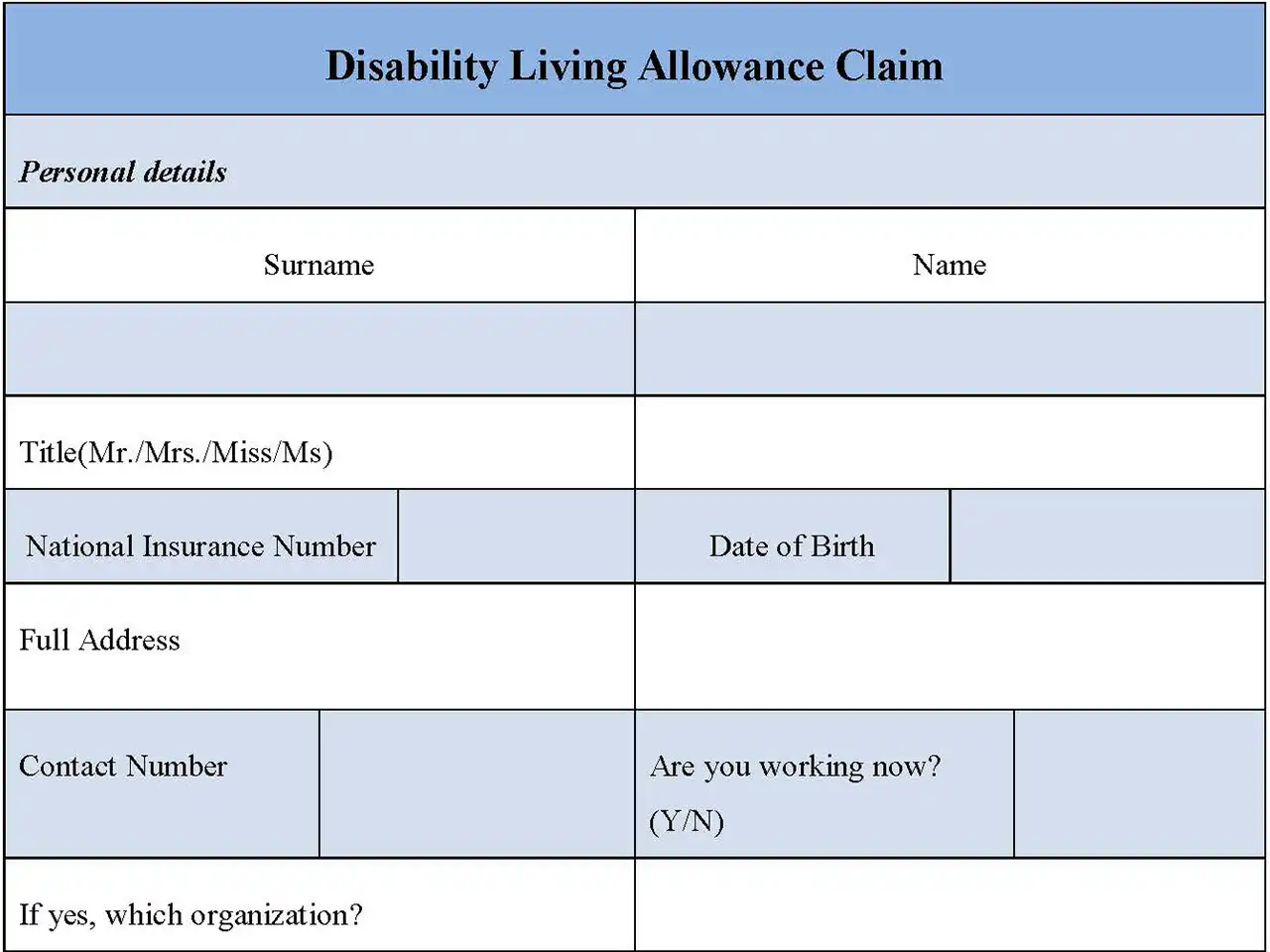

Disability Living Allowance Claim Form Editable PDF Forms

Level of help you need. Lowest. £28.70. Help for some of the day or with preparing cooked meals. Middle. £72.65. Frequent help or constant supervision during the day, supervision at night or.

Disabled Person’s Allowance Stronger Together Northern Ireland

In 2024, the average SSDI payment for an individual is $1,537, but almost two-thirds of SSDI recipients receive less than that. And only 10% of SSDI recipients receive $2,000 per month or more. Find out if you qualify for SSDI benefits. Pre-qualify in 60 seconds for up to $3,822 per month and 12 months back pay.

Attendance Allowance Application Form Return Address ARCADIA

First of all, your disability accreditation from abroad, won´t be recognised here in Spain. To be able to make use of services or benefits available in Spain, you´ll have to have your disability assessed through the Spanish Social Security system. First port of call would be your GP and a visit to Social Services in your Town to help you with.

Disability Economic Benefits, Spain, 1999 Download Table

Posted in: Health, Taxation, Author: Richelle de Wit. Tags: disability tax allowances. Tax Allowances for disability are based on percentage of disability - for year 2019: 33-65% accredited disability - allowance of €3000.00. 66-100% accredited disability - allowance of €9000.00. Further info in.

How to Pay Tax in Spain and What is the Tax Free Allowance?

The requirements vary depending on the degree of permanent disability. Partial permanent disability: if the cause of your disability was an ordinary illness, you must be registered in the social security system and have paid contributions for 1 800 days during the 10 years prior to the date when your temporary disability became a permanent disability.

Petition · military disability allowance for children ·

A personal allowance, which is generally EUR 5,550. The allowance is EUR 6,700 when the taxpayer is over 65 years of age and EUR 8,100 when the taxpayer is over 75 years of age. When the taxpayer is disabled, allowance is increased by EUR 3,000 or, if the disabled taxpayer's level of disability is 65% or more, by EUR 9,000.

UK Maternity Pay All You Need To Know! Cashfloat

Spain's VAT rate in 2023 is: 21% for general goods & services. 10% reduced rate for transport, non-basic food, toll roads, government services. 4% reduced rate for essentials. Spain's property tax rate for 2023: The property tax rate in Spain's between 0.4% to 1.1% of the cadastral value of the property.

Applying For & Securing Disability Living Allowance (DLA), January 19

Regional deductions in Income Tax for people with disabilities. We inform you of the deductions on the regional quota that some Autonomous Communities have established for people with disabilities applicable to your income tax return for the 2023 financial year.

Disability Living Allowance DLA how to apply Pinpoint

Attendance Allowance rate per week from April 2023. Lower rate - £68.10 - If you need frequent help or constant supervision during the day, or supervision at night. Higher rate - £101.75 If you need help or supervision throughout both day and night, or a medical professional has said you might have 12 months or less to live.

How to find the right disability allowances for your circumstances

We offer support through our free advice line on 0800 678 1602. Lines are open 8am-7pm, 365 days a year. We also have specialist advisers at over 120 local Age UKs. Disability Living allowance (DLA) is a benefit for people who need extra care and support in their daily lives. Find out who is eligible from Age UK now.